Best Citibank Credit Cards in Singapore (2024)

Citi PremierMiles Card

| Citi Miles | Category | Monthly Cap |

|---|---|---|

| 1.2 | Local spend | No Cap |

| 2 | Foreign currency spend | No Cap |

| 6.2 | Agoda (hotel) | No Cap |

| 10 | Kaligo (hotel) | No Cap |

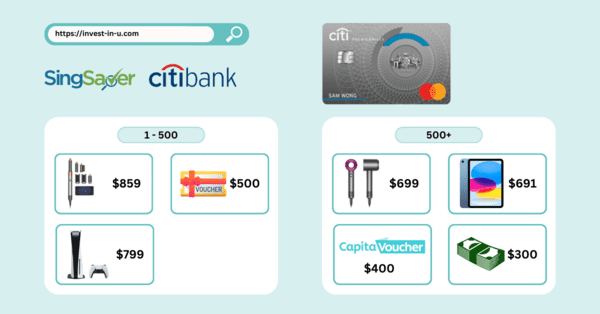

SingSaver + Citibank Flash Deal:

Apr 9 (9am) – Apr 30

First 500 applicants

Starting from 501

Requirements:

Once applied, make sure to submit the reward redemption form to SingSaver within 14 days of applying regardless of whether you’ve received the result. Otherwise, you won’t be eligible for the sign-up gift.

Citi Cash Back+ Card

SingSaver Exclusive Promotion:

Apr 9 (9am) – Apr 30

First 500 applicants

Starting from 501

Requirements:

Once applied, make sure to submit the reward redemption form to SingSaver within 14 days of applying regardless of whether you’ve received the result. Otherwise, you won’t be eligible for the sign-up gift.

Citi Cash Back Card

| Cash Back | Category |

|---|---|

| 8% | Private commute (taxi, grab, gojek, etc) |

| 6% | Groceries |

| 6% | Dining |

| 20.88% | Esso & Shell |

| 8% | Other petrol stations |

| 0.2% | Other retail purchases |

Citi Rewards Card

Enjoy S$1= x10 points = 4 miles or 2.27% cashback on the following transactions

| Rewards | Category |

|---|---|

| x10 | Online purchases (except for travelling related) |

| x10 | Department stores, clothing stores, shoes stores, luggage and leather goods |

| x1 | Other purchases |

FAQ

Once you submit the credit card application form successfully, an auto triggered email will be sent to you on the email address specified in the form. The email will contain a link that will let you check your application status.

You may choose any of the following methods to activate your card as per your convenience:-

a) Citi Mobile®

1. Launch ‘Citibank SG’ mobile application on your mobile

2. Sign on with your User ID and Password

3. Tap on ‘Profile and Settings’ icon on the top left

4. Under ‘Credit card settings’, tap on the credit card you want to activate, and tap ‘Activate’

5. Please enter the Unlock Code One-Time PIN (OTP) or the OTP sent via SMS

b) Citibank Online

1. Sign on with your User ID and Password

2. Under ‘Services’ > ‘My Profile’, click on ‘Card Activation’ link and follow the steps on-screen

3. Please enter the One-Time PIN (OTP) generated using your Citi Mobile Token or your Online Security Device (OSD) or request for an OTP via SMS

4. Click ‘Continue’ to proceed

You need to be at least 21 years old or above to apply for a Citi Credit Card. However, the minimum annual income criteria depends on the type of credit card and your residential status. The annual income requirement for foreign nationals is higher as compared to Singapore Citizens. You can check the eligibility criteria for your preferred credit card at the respective credit card page.

You will require the following documents to apply for a Citi Credit Card :-

If you are a Salaried Employee

A copy of your NRIC/passport.

Latest original computerized pay slip.

Or

Tax Notice of Assessment or last 12 months CPF statement.

If you are Self Employed

A copy of your NRIC/passport.

Last 2 years’ Income Tax Notice of Assessment.

Last 3 months’ bank statements.

If you are a Foreign National

A copy of your passport and work permit (with minimum 6 months validity).

A copy of utility/telephone bill or bank statement with your name and address.

Income Tax Notice of Assessment and latest original computerized pay slip.