Best DBS/POSB Credit Cards Singapore (2024)

POSB Everyday Card

| Cashback | Category |

|---|---|

| 10% | Food delivery |

| 7% | ShengSiong |

| 5% | Redmart |

| 5% | Online shopping |

| 5% | SimplyGo |

| 5% | Utilities |

| 3% | Teleco |

| 3% | Dining |

| 3% | Watsons |

| 0.3% | Other spend |

- Up to 20.1% + 2% fuel savings at SPC

- 20% off Sentosa Fun PassTM Tickets

- 50% off admission tickets for Jurong Bird Park, Night Safari, River Wonders and Singapore Zoo

- Welcome offer: S$150 cashback when charge a minimum of S$800 within the first 60 days from card approval date

- Annual fee: S$192.60

- Eligibility: 21 years and above, minimum annual income of S$30,000 (Singaporean and PR) or S$45,000 (Foreigner)

DBS Live Fresh Card

- Singapore’s first-ever eco-friendly recycled card, made from 85.5% recycled plastic

- Up to 5% cashback on online & contactless spend

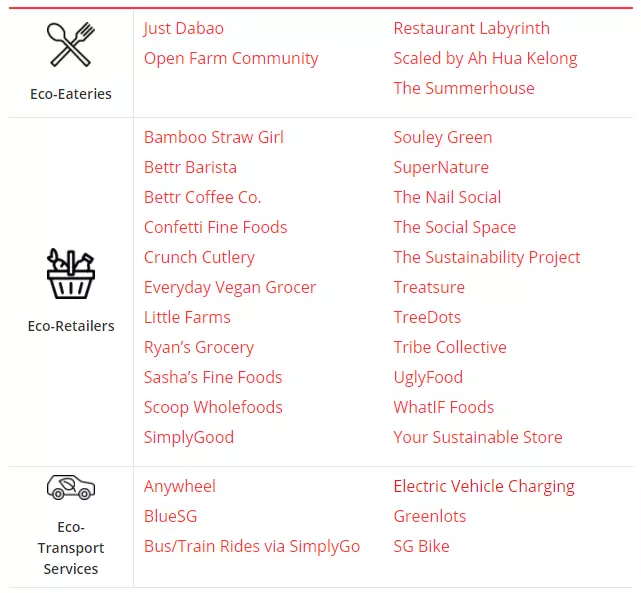

- Additional 5% green cashback on selected Eco-eateries, retailers and transport services as below

- 0.3% cashback on all other spend

- Minimum spend: S$600

- Cashback cap: S$75

- Welcome offer: S$150 cashback when charge a minimum of S$800 within the first 60 days from card approval date

- Annual fee: S$196.20 (1st year waived)

- Eligibility: 21 years and above, minimum annual income of S$30,000 (Singaporean and PR) or S$45,000 (Foreigner)

DBS Altitude Card

- S$1 = 10 miles on hotel transactions at Kaligo

- S$1 = 3 miles on online flights & hotel transactions

- S$1 = 2 miles on overseas spend

- S$1 = 1.2 miles on local spend

- Miles earned will never expire

- Welcome offer: S$150 cashback when charge a minimum of S$800 within the first 60 days from card approval date

- Annual fee: S$192.60

- Eligibility: 21 years and above, minimum annual income of S$30,000 (Singaporean and PR) or S$45,000 (Foreigner)

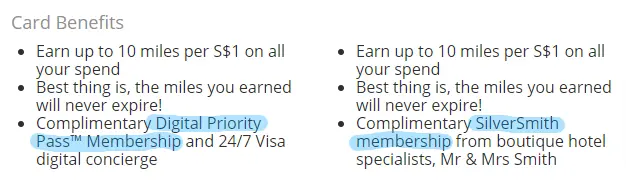

The main difference between the two are:

- Visa: complimentary Digital Priority Pass membership

- Amex: complimentary SilverSmith membership

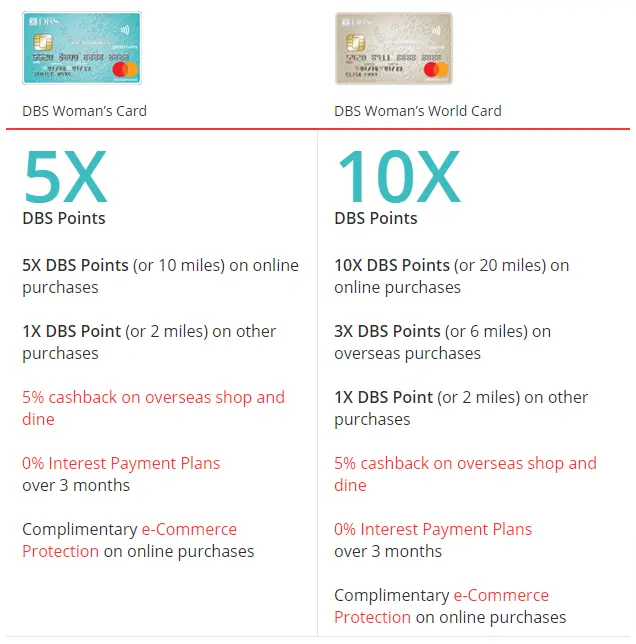

DBS Woman’s Credit Card

- Up to 10X DBS Points (or 20 miles) per S$5 spent on online and overseas purchases

- Split big purchases and enjoy 0% Interest on My Preferred Payment Plan

- Complimentary e-Commerce Protection for online purchases

- Welcome offer: S$150 cashback when charge a minimum of S$800 within the first 60 days from card approval date

- Annual fee:

- DBS Woman’s Card – S$160.50

- DBS Woman’s World Card – S$192.60

- Eligibility: 21 years and above, minimum annual income:

- DBS Woman’s Card – S$30,000 (Singaporean and PR) or S$45,000 (Foreigner)

- DBS Woman’s World Card – S$80,000 for all

Related Post

FAQ

What is DBS credit card hotline?

DBS credit card hotline is 1800 339 6963 or (65) 6339 6963 from overseas