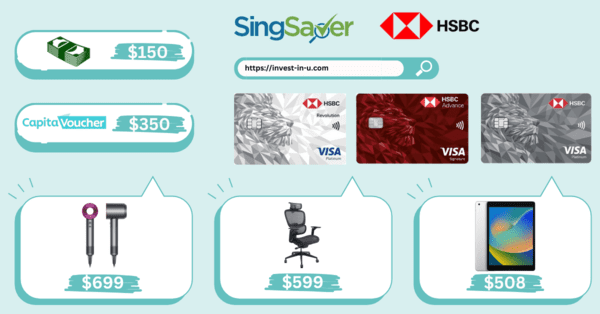

Best HSBC Credit Cards Singapore (2024)

HSBC Revolution Credit Card

| S$1=4 miles or 2.5% cashback | Visa PayWave |

| S$1=4 miles or 2.5% cashback | Online |

| S$1=4 miles or 2.5% cashback | Apple Pay |

| S$1=4 miles or 2.5% cashback | Google Pay |

Requirements:

HSBC Visa Platinum Credit Card

| 5% cashback | Dinning |

| 5% cashback | Groceries |

| 5% cashback | Fuel |

| additional 17% discount | Caltex & Shell |

HSBC Advance Credit Card

| Cashback | Category | Minimum Monthly Spend |

|---|---|---|

| 1.5% | local & overseas | NA |

| 2.5% | local & overseas | S$2,000 |

HSBC TravelOne Credit Card

FAQ

What is HSBC Singapore credit card hotline?

HSBC Singapore credit card hotline is 1800-227 6868 or +65 6227 6868