Standard Chartered Smart Credit Card (Highly Recommended )

S$1=5.5 miles 6% cashback Categories Merchants Fast Food Burger King, KFC, Mcdonald’s, Subway Coffee & Toast Fun toast, Toast Box, Ya Kun Kaya Toast Digital Subscriptions Disney+, Netflix, Spotify, Youtube Daily Commute Bus & MRT

Convert your transactions into 3-month interest-free 20.7% savings at Caltex 10% off on Qater Airways No Annual Fees: waived forever Annual income requirements: S$30,000 (local/PR) or S$60,000 (foreigner) SingSaver Exclusive Promotion:

Apple AirPods Gen 2 (worth $271.50) S$270 Cash

Citi Cash Back+ Card

1.6% No No Up to S$1 million FREE Annual fee: S$194.40 (first year waived) Annual income requirements: S$30,000 (local/PR) or S$42,000 (foreigner) SingSaver Exclusive Promotion:

Dyson Supersonic (worth S$699) Nintendo Switch OLED (worth S$549) Dyson V8 Slim Fluffy (worth S$509) S$300 cash

Citi Cash Back Card

6% 8% 0.25% cash back on all other retail spends Up to 20.88% Monthly minimum spend S$800 Monthly cash back cap S$80 Up to S$1 million FREE Annual fee: S$194.40 (first year waived) Annual income requirements: S$30,000 (local/PR) or S$42,000 (foreigner) SingSaver Exclusive Promotion:

Dyson Supersonic (worth S$699) Nintendo Switch OLED (worth S$549) Dyson V8 Slim Fluffy (worth S$509) S$300 cash

Citi Rewards Card

S$1=4 miles 2.27% cash back

Online & Offline Shopping

Grab & Gojek

Online Food Delivery

Online Groceries

No Up to S$1 million FREE Rewards validity: 5 years Annual fee: S$194.40 (first year waived) Annual income requirements: S$30,000 (local/PR) or S$42,000 (foreigner) SingSaver Exclusive Promotion:

Dyson Supersonic (worth S$699) Nintendo Switch OLED (worth S$549) Dyson V8 Slim Fluffy (worth S$509) S$300 cash

Citi PremierMiles Card Categories Rewards Local Spend 1.2x miles Foreign Currency Spend 2x miles Pay Annual Fee 10,000 miles (S$1=51 miles)

No No 2 complimentary Up to S$1 million FREE Rewards validity: no expiry Annual fee: S$194.40 (first year waived) Annual income requirements: S$30,000 (local/PR) or S$42,000 (foreigner) SingSaver Exclusive Promotion:

Dyson Supersonic (worth S$699) Dyson V8 Slim Fluffy (worth S$509) Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$503.65) S$300 cash

Standard Chartered Journey Credit Card (New )

S$1=3 miles Categories Merchant Examples Transportation Gojek, Cabcharge Asia, Tada, Ryde Food Delivery Foodpanda, Deliveroo, Groceries & Food NTUC FairPrice Online, NTUC

S$1=2 miles for foreign spends S$1=1.2 miles for local spends Rewards does not 2 complimentary FREE S$10 off Grab rides to or from Changi Airport 20.7% savings at Caltex 10% off on Qater Airways S$0 foreign transaction fee in Jun, Jul, Nov & Dec 2023 No Annual fees: S$194.40 (waived for the 1st year) Annual income requirements: S$30,000 (local/PR) or S$60,000 (foreigner) Standard Chartered Signup Gift:

Extra in addition

SingSaver Exclusive Promotion (on top of SCB’s):

Get extra

OCBC 365 Credit Card Cashback Categories 6% All petrol service stations 5% Dining & online food delivery 3% Groceries 3% Land transport (bus, train, taxi, private hire rides) 3% Telco & utility bills 3% Pharmacy, e.g. Guardian and Watson 3% Streaming, e.g. Netflix, Disney+, Spotify and Apple Music 3% Electric Vehicle (EV) Charging (New), e.g. SP Digital, Greenlots, CDG ENGIE and City Energy 22.92% Caltex 21.04% Esso 0.3% Other spends

Minimum Monthly Spend Cashback Cap S$800 S$80 S$1600 S$160

Annual fees: S$196.20 (waived for the first 2 years Eligibility: 21 years and above, minimum annual income of S$30,000 (Singaporean and PR) or S$45,000 (Foreigner) SingSaver Exclusive Promotion:

Samsonite Volant Spinner 68/25 EXP + 2x Apple AirTag (worth S$570.80) Apple AirPods (Generation 3) with Magsafe Charging Case (worth S$274) S$250 cash via PayNow Promotion Period: 1 – 15 February 2024 Requirements:

Didn’t hold any OCBC credit card within the last 12 months Spend a minimum of S$500 within 30 days of card approval Once applied, make sure to submit the reward redemption form to SingSaver within 14 days of applying regardless of whether you’ve received the result. Otherwise, you won’t be eligible for the sign-up gift.

OCBC Titanium Rewards Credit Card

S$1=4 miles S$1=4 miles Alibaba Daigou Mustafa Centre AliExpress Ezbuy Qoo10 Amazon IKEA Shopee Courts Lazada Taobao

Get a bonus 2% cash rebate on electronics at Best Denki No Annual fees: S$192.60 (waived for the first 2 years Annual income requirements: S$30,000 (local/PR) or S$45,000 (foreigner) SingSaver Exclusive Promotion:

Samsonite Volant Spinner 68/25 EXP + 2x Apple AirTag (worth S$570.80) Apple AirPods (Generation 3) with Magsafe Charging Case (worth S$274) S$250 cash via PayNow Promotion Period: 1 – 15 February 2024 Requirements:

Didn’t hold any OCBC credit card within the last 12 months Spend a minimum of S$500 within 30 days of card approval Once applied, make sure to submit the reward redemption form to SingSaver within 14 days of applying regardless of whether you’ve received the result. Otherwise, you won’t be eligible for the sign-up gift.

OCBC 90°N Mastercard/Visa Card

S$1=7 miles S$1=2.1 miles on foreign spend S$1=1.3 miles on local spend No No Miles validity: no expiry Annual fees: S$54.00 (waived for the first year) Annual income requirements: S$30,000 (local/PR) or S$45,000 (foreigner) SingSaver Exclusive Promotion:

Samsonite Volant Spinner 68/25 EXP + 2x Apple AirTag (worth S$570.80) Apple AirPods (Generation 3) with Magsafe Charging Case (worth S$274) S$250 cash via PayNow Promotion Period: 1 – 15 February 2024 Requirements:

Didn’t hold any OCBC credit card within the last 12 months Spend a minimum of S$500 within 30 days of card approval Once applied, make sure to submit the reward redemption form to SingSaver within 14 days of applying regardless of whether you’ve received the result. Otherwise, you won’t be eligible for the sign-up gift.

DBS Vantage Card

1.5% cash back or 1.5x miles for local spend 2.2% cash back or 2.2x miles for overseas spend S$1=6 miles 19% off at Esso Members-only dining privileges 10 complimentary visits Annual fees: S$594 (received 25,000 miles upon paying annual fees) Annual income requirements: S$120,000 (local, PR or foreigner) DBS Signup Gift:

New cardmembers: 55,000 miles

Existing cardmembers: 35,000 miles

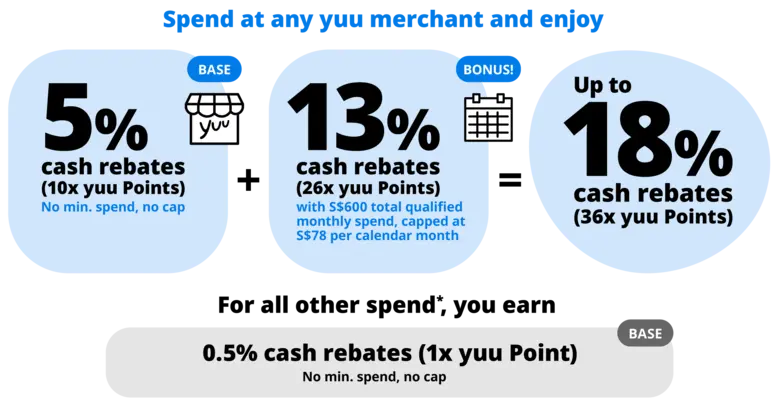

DBS yuu American Express/Visa Card

5%

By spending S$600 in a month, you will enjoy additional 13% cash rebate, total 18%

Annual fees: S$194.40 (1st year waived) Annual income requirements: S$30,000 (local/PR) or S$45,000 (foreigner) DBS Signup Gifts:

New Customer Existing Customer Amex S$350 S$120 Visa S$300 S$80

CIMB Visa Signature Card

10%

Online Shopping

Groceries

Beauty & Wellness

Pet Shops & Veterinary Services

Cruises

Minimum monthly spend S$800 Monthly cashback cap S$100 Annual fees: waived forever Annual income requirements: S$30,000 (local/PR) SingSaver Exclusive Promotion:

Apple iPad 9th 10.2″ WiFi 64GB (worth S$503.65) S$320 Cash

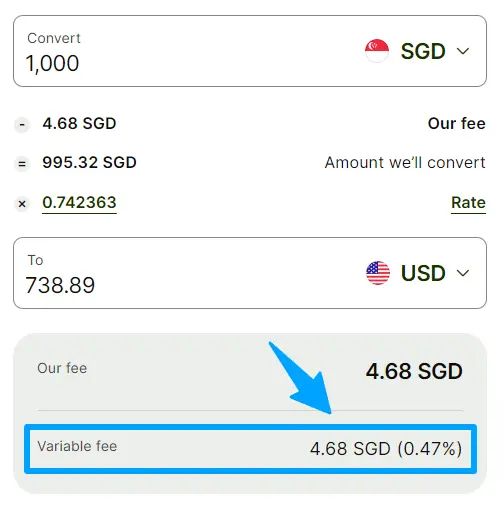

Wise Card Issued by Wise Singapore, formerly known as TransferWise, regulated by Monetary Authority of Singapore (MAS)

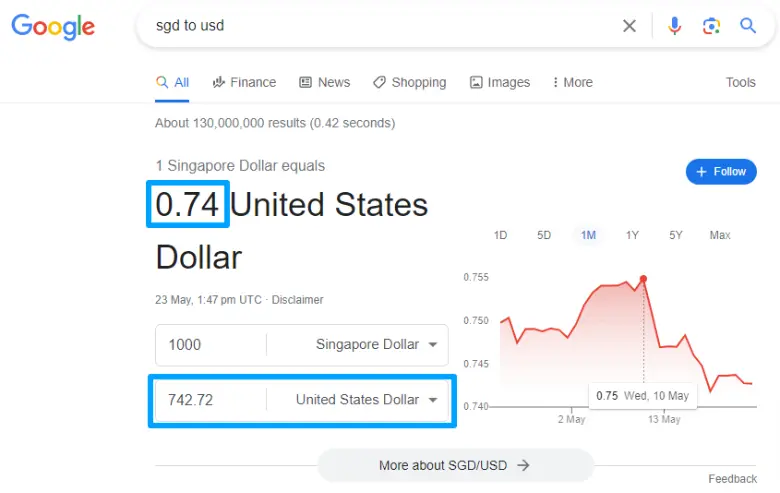

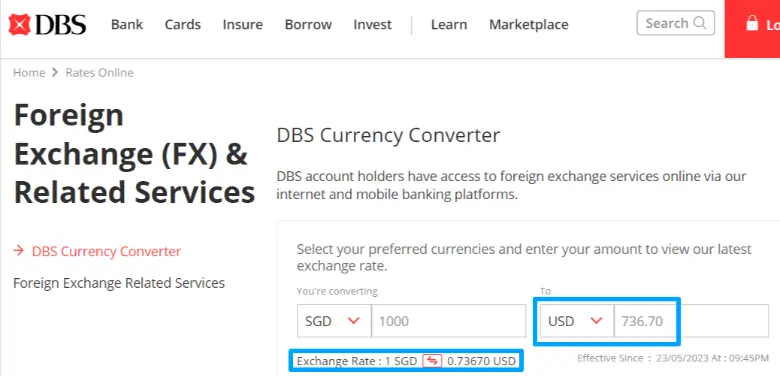

Send and spend money in Singapore dollars and more than 50 different currencies No need to exchange and carry so much cash while travelling abroad Convert SGD automatically to foreign currency Real exchange rate used without any markup Free Accepted in shops and restaurants all over the world Free Top up, check balance and transactions, freeze card or convert in real time with Wise app Low 0.47% No No SGD/USD SGD1,000 to USD Wise Card 0.74263 739.16 (after fees ) Google 0.74272 742.72 DBS 0.73670 736.70 (before fees)

HSBC Visa Platinum Card

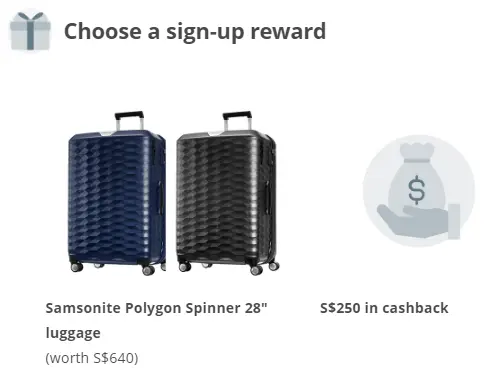

5% Additional 1% cashback with HSBC Everyday Global Account 17% Annual fee: SGD194.40 (1st year waived) Annual income requirements: S$30,000 (local/PR) or S$40,000 (foreigner) HSBC Signup Gifts:

Samsonite ZELTUS 69cm Spinner Exp with built-in scale (worth S$680) or S$150 cash back

HSBC Advance Credit Card

Up to 2.5% cashback on local and overseas purchases Minimum Spend Cash Back NA 1.5% S$2,000 2.5%

Complimentary travel insurance coverage up to SGD500,000 Annual fee: SGD194.40 (1st year waived) Annual income requirements: S$30,000 (local/PR) or S$40,000 (foreigner) HSBC Signup Gifts:

Samsonite ZELTUS 69cm Spinner Exp with built-in scale (worth S$680) or S$150 cash back

HSBC TravelOne Credit Card (New )

S$1 = 2.4 miles on foreign currency spend S$1 = 1.2 miles on local spend No No 4 complimentary Complimentary No conversion fee for air miles or hotel points redemption until Dec 2023 Annual fee: S$194.40 Annual income requirements: S$30,000 (local/PR) or S$40,000 (foreigner)

HSBC Revolution Credit Card S$1=4 miles or 2.5% cashback Visa PayWave S$1=4 miles or 2.5% cashback Online S$1=4 miles or 2.5% cashback Apple Pay S$1=4 miles or 2.5% cashback Google Pay

Monthly minimum spend: NA Monthly cap for high rewards spend: S$1,000 Rewards validity: 3 years Annual fee: waived forever Annual income requirements: S$30,000 (local/PR) or S$40,000 (foreigner)

NTUC Link Card / Trust Link Card

No No No Annual income requirements: S$30,000 (local/PR) or S$60,000 (foreigner) NTUC Link Card: up to 21%

Trust Link Card: up to 15%

FPG groceries refer to FairPrice, FairPrice Finest, FairPrice Xtra, FairPrice Xpress (excluding Esso outlets), FairPrice online, Warehouse Club, Unity, Cheers (excluding Esso outlets).

S$10 FairPrice E-Voucher

Coupon

UOB Absolute Cashback Card

1.7% ALL No No Annual fees: S$194.40 (1st year waived) Annual income requirements: S$30,000 (local/PR) or S$40,000 (foreigner) UOB Signup Gift:

UOB EVOL Credit Card

8% Minimum monthly spend S$600 Monthly cashback cap S$60 Annual fees: S$194.40 (waived when make minimum 3 transactions per month) Annual income requirements: S$30,000 (local/PR) or S$40,000 (foreigner) UOB Signup Gift:

KrisFlyer UOB Credit Card

S$1=3 miles S$1 =3 miles S$1=1.2 miles on other spend Annual fees: S$194.40 (1st year waived) Annual income requirements: S$30,000 (local/PR) or S$40,000 (foreigner) UOB Signup Gift:

UOB PRVI Miles Visa Card Category Rewards Local Spend S$1= 1.4 miles Foreign Spend S$1= 2.4 miles Agoda S$1= 6 miles Expedia S$1 = 8 miles

Free travel insurance up to S$500,000 S$20 off Grab rides Annual fees: S$259.20 (1st year waived) Annual income requirements: S$30,000 (local/PR) or S$40,000 (foreigner) UOB Signup Gift: