Best HSBC Credit Cards in Malaysia (2024)

HSBC Malaysia has totally issued 9 different types of credit cards. We help you pick the top 3.

Best HSBC Credit Cards in Malaysia

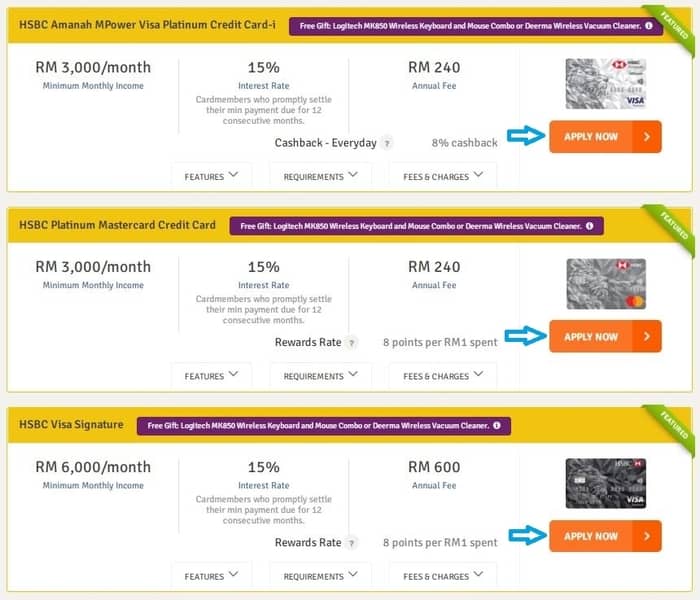

HSBC Amanah MPower Platinum Credit Card-i

HSBC Platinum Credit Card

HSBC Visa Signature Credit Card

How to Apply for HSBC Credit Cards Malaysia via CompareHero

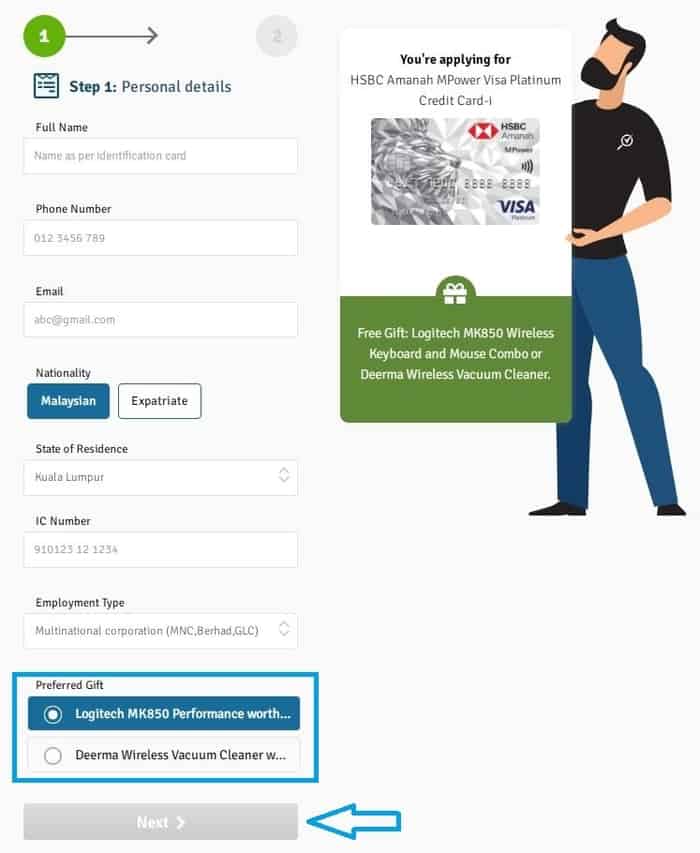

Step 1: Head to CompareHero.my, select the credit card you want, then click “APPLY NOW“

Step 2: Fill in personal details, select the Free Gift you like, then click “Next“

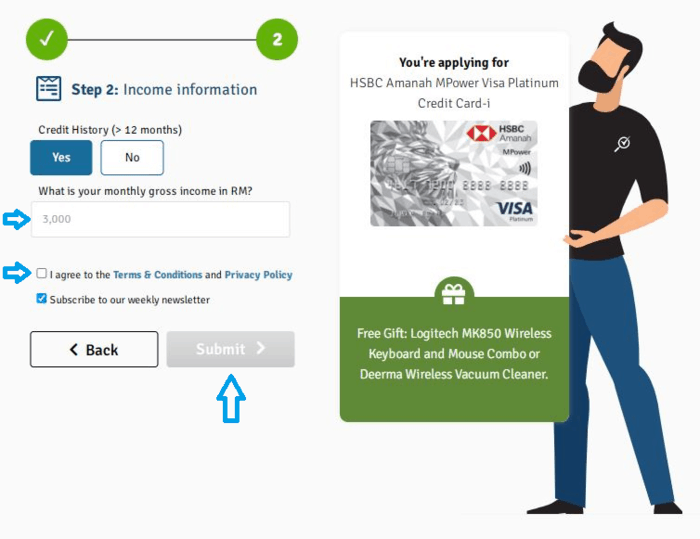

Step 3: Input your monthly income, accept the T&C before clicking “Submit“

How to Activate HSBC Credit Card & Set up PIN Malaysia

- Step 1: Call HSBC 24-hour card activation hotline: +603 8321 8999

- Step 2: Press “1” to activate credit card.

- Step 3: Once done, press “2” to create credit card PIN

How to Pay HSBC Credit Card Bill Online Malaysia Step by Sep

- Step 1: Download HSBC Malaysia Mobile Banking App

- Step 2: Log in with your biometrics or 6-digit pin

- Step 3: Select “Move Money” and click on the “Pay and Tranfser” option

- Step 4: Under “From“, select the account you wish to deduct the payment

- Step 5: Under “To“, select the credit card you wish to pay

- Step 6: Input the amount you wish to pay and reference if needed

- Step 7: Click on “Continue“

- Step 8: Verify the details then click “Confirm“

Document Required to Apply for HSBC Credit Card

Salaried Employee

- Photocopy of MyKad (both sides)

- Recent utility bill if the address on MyKad is different from your residential address

- Latest month salary slip or letter of confirmation from employer if employed less than 3 months OR

- Latest income tax return (Form BE with tax receipt) or Form EA or EPF statement

Self-Empolyed

- Photocopy of MyKad (both sides)

- Recent utility bill if the address on MyKad is different from your residential address

- Photocopy of Business Registration Form (established minimum 2 years)

- Latest income tax return (Form B with payment receipts or CPO2 attached or EPF statement ) OR

- Latest 6 months bank statements

Foreigner

- Copy of passport showing personal details and work permit (must be valid for at least one year)

- Latest month salary slip

- Letter of confirmation from employer stating position, remuneration and duration of employment

About HSBC Malaysia

On Oct 1, 1984, Hongkong Bank Malaysia Berhad was established. Ten years later, on Jan 1, 1994, The Hongkong and Shanghai Banking Corporation Limited’s Malaysian branch operations were localized and transferred to Hongkong Bank Malaysia Berhad, making it the first foreign-owned financial institution to do so. On Feb 23, 1999, the formal name HSBC Bank Malaysia Berhad was adopted.

FAQ

HSBC Bank Malaysia (Banking & Cards)

Local call numbers: 1300 88 1388

International call numbers: +603 8321 5400

Operation hours: 7:30am – 9:30pm

HSBC Amanah (Banking & Cards)

Local call numbers: 1300 80 2626

International call numbers: +603 8321 5200

Operation hours: 7:30am – 9:30pm

You should call 1-300-88-1727 / +603-8321-5400 to report any lost/stolen HSBC credit cards immediately.